SRI-KEHATI Index-based Investment Products differ from traditional investments, which only aim at offering financial returns to investors. Through SRI-KEHATI-based mutual funds, KEHATI, in collaboration with investment managers, strives to provide an added value by opening opportunities for investors to also be able to contribute to the community and its environment.

The results of the investment managers’ allowance and/or contribution received by KEHATI are used to finance Indonesia’s biodiversity utilization program in a sustainable manner. With its good performance, SRI-KEHATI has received good reception and recognition from various parties in the capital market. This is proven by the use of SRI-KEHATI as an investment vehicle through the issuance of various mutual funds, as follows:

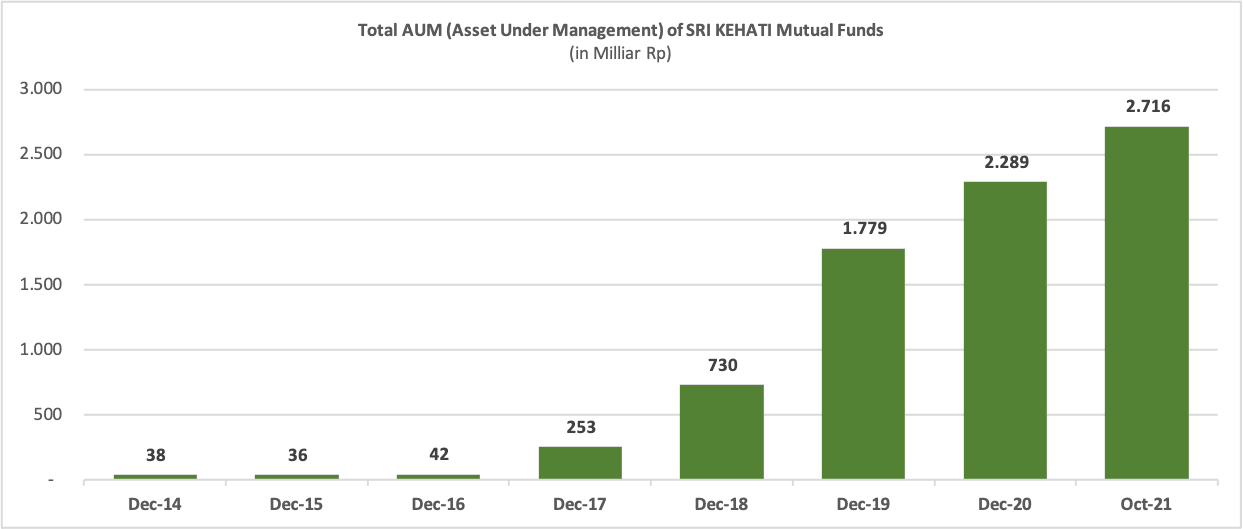

As of October 31, 2021, the total managed funds from the 11 SRI-KEHATI index-based mutual funds had reached Rp 2.7 Trillion. The development of SRI-KEHATI-based index managed fund in a nutshell can be seen in the following graph:

Further explanation for each mutual fund, can be seen below.

Premier ETF Mutual Funds "XISR"

The Premier ETF SRI-KEHATI is an equity funds that is traded on the Indonesia Stock Exchange (IDX). The SRI-KEHATI Premier ETF aims to provide returns equivalent to the performance of the SRI-KEHATI Index issued by the IDX in collaboration with the KEHATI Foundation. The SRI-KEHATI Premier ETF is the first ETF with the SRI (Sustainable and Responsible Investment) category in Southeast Asia and a special ETF with the theme of companies that care about Indonesian Biodiversity.

Investment Manager Website:

Mutual funds product:

Seller agent website:

RHB Index Mutual Fund SRI-KEHATI Index Fund

The RHB Index Mutual Fund SRI-KEHATI Index Fund aims to provide investment returns that are equivalent to the performance of the SRI-KEHATI Index. This mutual fund is suitable for Investors who want investment diversification in instruments that are in accordance with the principles of Responsible Investment.

Investment Manager Website:

Mutual funds product:

Seller agent website:

SRI-KEHATI Liquid Insight Index Mutual Funds

The SRI-KEHATI Liquidity Insight Index Mutual Fund aims to provide optimal investment returns through investments in equity securities issued by corporations offered through a public offering and traded on the Indonesia Stock Exchange listed on the SRI-KEHATI Index and can invest in debt securities and or derivative effects that have a maturity of not more than one year, and provide an opportunity for the unit holder to contribute to the KEHATI Foundation to support various biodiversity conservation programs in Indonesia.

Investment Manager Website:

Mutual funds product:

Seller agent website:

SRI-KEHATI Index Simas Funds

It is an Investment Fund that is managed to obtain investment returns that refer to the performance of the SRI-KEHATI Index.

Investment Manager Website:

Seller agent website:

AYERS Equity Index SRI-KEHATI Mutual Funds

It is an Investment Fund that is managed to obtain investment returns that refer to the performance of the SRI-KEHATI Index.

Investment Manager Website:

Mutual funds product:

Seller agent website:

SRI-KEHATI BNP Paribas Index Mutual Funds

BNP Paribas SRI-KEHATI is a stock index mutual fund that follows the SRI-KEHATI stock index. The stock’s constituents in the index consist of 25 listed public companies and are selected by the KEHATI Foundation every semester. Contributions from the SRI KEHATI BNP Paribas Mutual Fund will be used to fund programs run by KEHATI Foundation that focus on agroecosystems/agriculture to help improve economic and environmental conditions in the long run.

Investment Manager Website:

Mutual funds product:

Seller agent website:

Batavia Mutual Fund SRI-KEHATI ETF

Batavia SRI-KEHATI ETF aims to provide investment returns equivalent to the performance of the SRI-KEHATI Index published by the Indonesia Stock Exchange, in collaboration with the KEHATI Foundation.

Investment Manager Website:

Mutual funds product:

Seller agent website:

Panin SRI-KEHATI Index Mutual Funds

It is an Investment Fund that is managed to obtain investment returns that refer to the performance of the SRI-KEHATI Index.

Investment Manager Website:

Seller agent website:

Batavia Mutual Funds ESG Impact Shares

Batavia Mutual Fund ESG Impact Shares are actively managed funds in which Batavia PAM in the selection process of its constituent shares uses the List of Shares selected and issued by KEHATI as a reference.

Investment Manager Website:

Mutual funds product:

Seller agent website:

Mutual Fund KEHATI Lestari (RDKL)

Mutual Fund KEHATI Lestari (RDKL) is a Fixed Income Mutual Fund (0-20% Shares, 80-100% Bonds, 0-20% Money Market/Cash Market), which is environmentally sound and invests only in actively managed government bond portfolios.

RDKL aims to raise financial support from the community to help sustain the financing of biodiversity programs organized by KEHATI Foundation through the concept of investment in the form of mutual funds.

RDKL was launched by KEHATI in April 16, 2007, in collaboration with PT Bahana TCW Investment Management as the Manager. Companies that enter are those who have allocated Corporate Social Responsibility or Green Investment funds. In this mutual fund product, investors can donate their investment to KEHATI Foundation through alternatives as follows:

Investment Manager Website:

Mutual Funds Product:

STAR ETF SRI-KEHATI

STAR ETF SRI-KEHATI Index Mutual Fund is an Exchange Traded Fund/ETF mutual fund and has obtained an effective statement from the Financial Services Authority and is recorded in the Indonesia Stock Exchange (IDX). SRI-KEHATI Index Mutual Fund is offered to the public at an initial Net Asset Value (NAB) of IDR 200,- (two hundred rupiahs) or equivalent to IDR 20,000,000,- (twenty million rupiahs) per 1 (one) Creative Unit in the prime market.

In this collaboration synergy, STAR AM acts as the Investment Manager, KEHATI Foundation as the Index Owner, and Sinarmas as the Participant Dealer for this STAR ETF SRI-KEHATI (XSRI) product. In addition, STAR AM cooperates with PT. Bank Central Asia, Tbk as the Custodian Bank of this XSRI product.

This STAR ETF SRI-KEHATI Index Mutual Fund is an Index Mutual Mund managed to obtain investment returns that refer to the performance of the SRI-KEHATI Index.

Investment Manager Website:

ETF Mutual funds product:

Participant Dealer:

Can be purchased through:

SAM ETF SRI-KEHATI Index Mutual Fund

SAM ETF SRI-KEHATI Index Mutual Fund is an Exchange Traded Fund (ETF) with an ESG theme, namely a product that considers the elements of environment friendly, social responsibility, and Good Corporate Governance (GCG), and is managed to obtain investment returns that refer to the performance of the SRI-KEHATI Index.

Investment Manager Website:

ETF Mutual Funds Product:

Participant Dealer:

Can be purchased through:

Sucorinvest Sustainability Equity Fund

Sucorinvest Sustainability Equity Fund is a Thematic Stock Mutual Fund to support the Sustainable Development Goals (SDGs) Program; it is issued by Sucorinvest AM, in collaboration with KEHATI Foundation.

This Mutual Fund aims to provide an optimal investment return potential in the long run for the Participation Unit Holder by investing primarily on equity Stocks issued by corporations that support SDGs, and can provide opportunities to the Participation Unit Holder to contribute to the community and its environment.

Investment Manager Website:

Instagram:

Mutual Funds Product:

Can be purchased through:

Marketing Team/ Client Relation Sucor AM, email: